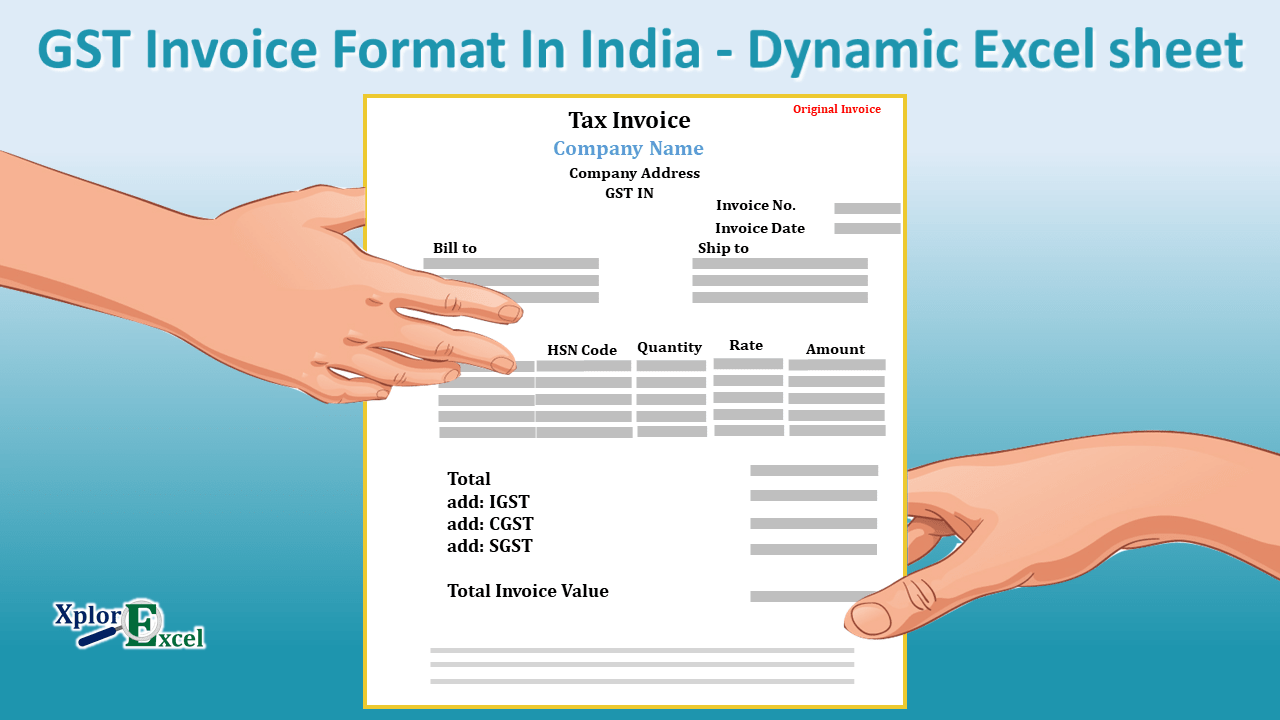

Nowadays, In India, The seller must have to register under the GST Act, if he has a turnover above Rs 40 lakh within the financial year. So every seller needs a GST invoice format. We have provided solutions for all sellers all over India. It is a dynamic GST invoice format in Excel.

GST Invoice Format in Excel

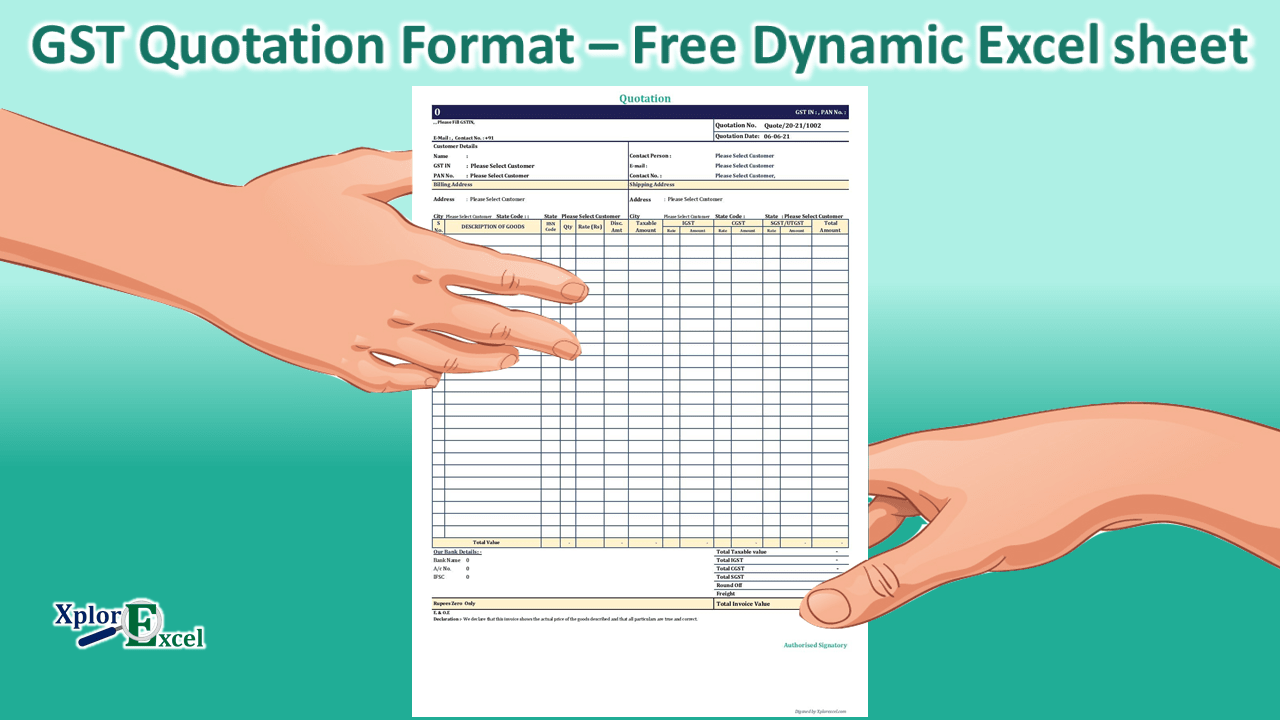

As per the new taxation system in India, Every registered dealer under GST has to make the invoice in the new format (GST Invoice Format)as guided by the Central Govt. or GST Act 2017. GST Invoice Format is a very crucial document in the GST Act, 2017 we have made software for you to provide help to you to generate GST invoices.

Check the Requirement of GST Invoice Format please Click Here

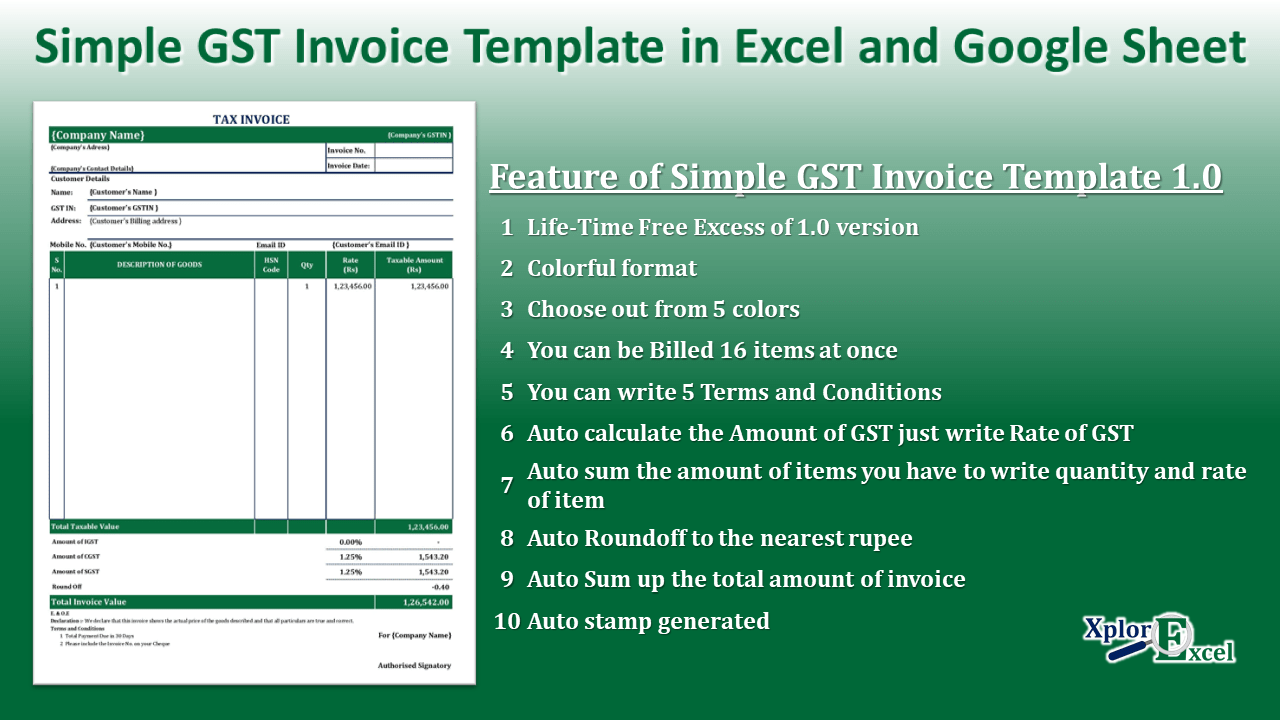

Feature of GST Offline Invoice Creator:

| 1 | You can be allowed to Trade discounts to your Customers charge in simple percentages and the amount will auto-calculate |

| 2 | Auto-generated and save the invoice in just one click |

| 3 | Auto-generated new invoice No. |

| 4 | Save of Invoice as a PDF in folders |

| 5 | Auto Detect type of Sale (Interstate or Intrastate) and charge the correct Type of GST i.e. IGST or CGST/SGST |

| 6 | Auto-detect the Rate of GST from the stock list. |

| 7 | Maintained the list of stock. So, you don’t need to add stock items again and again while generating an invoice |

| 8 | Maintained the list of Customers. Select from the list and generate the invoice |

| 9 | Upload Your Logo |

| 10 | Add a different shipping address |

| 11 | Add E-way bill details |

| 12 | Auto-generate Summary for all sale |

| 13 | GST amount is shown Item with the rate of percentage |

| 14 | Generate Three Copies of the Invoice -Customer Copy -Supplier Copy -Transported Copy |

| 15 | Auto Round off the total amount |

| 16 | Show all amounts in rupee and paise with one click |

| 17 | Show all amounts only in rupees with one click |

| 18 | Auto-generated total invoice amount in words |

| 19 | Add up to 10 Terms and conditions |

| 20 | You can add your bank details |

| 21 | Colorful invoice format |

| 22 | You can generate an invoice for up to 25 items |

| 23 | You can be allowed to Trade discounts to your Customers charge in simple percentages and the amount will auto calculate |

| 24 | You can be allowed to Trade discounts to your Customers charge in simple percentages and the amount will auto-calculate |

| 25 | You can add Contact person Details i.e Name, Email, and Mobile No. in the customer list database |

| 26 | You can add the amount of freight paid |

How to operate it

Download and Extract it

First, you have to download it from the link below and Extract it with the help of WinRAR (Click Here to Download) software then you get a folder: –

- Download – GST Offline Invoice Creating Software 3.1 release on date 11-10-2023

- Bug Fixes and little improvements

- Download – GST Offline Invoice Creating Software 3.0 release on date 17-05-2020

- Bug Fixes and little improvements

- All-new design and more new features

- Download – GST Offline Invoice Creating Software 2.1 release on the date 21-03-2019

- Bug Fixes and little improvements

- Download – GST Offline Invoice Creating Software 2.0 release on the date 25-10-2018

- Bug Fixes and little improvements

- All-new design and more new features

- Download – GST Offline Invoice Creating Software 1.1 release on the date 21-06-2018

- Bug Fixes and little improvement

- Download – GST Offline Invoice Creating Software 1.0 release on the date 10-06-2018

2. Enter Your Organisation details:

Now you have to open the Excel sheet from this folder and enable all the micro or options asked by Microsoft Excel then enter the details asked in the sheet Named: Organisation Details. This information will be asked for only one time by the software.

3. Add Inventories:

Now, you have to create your stock list for easy pop-up items at the time when you will create/generate an Invoice. You can also add any stock item at the time of creating/generating an Invoice.

Click on the Button Add New Item then there will pop up form fill this form and click on the Button Add New Item shown on the form. As shown in the image below.

4. Add some Customers:

Now, you have to create your Customer list for easy and speedy invoice generation. You can also add a New Customer at the time of creating/generating an Invoice.

Click on the Button Add Customer then there will pop up form fill this form and click on the Button Add New Customer to the Database shown on the form. As shown in the image below.

5. Create Invoice:

Now, Goto sheet Create Invoice and select customer with the help of two options explained below:

1. Search Customer:

If you have already added the customer in the database then select it with the help of search customer and insert it into an invoice. and with the help of the second option, You will be redirected to the Form of Add new Customer.

2. Add Customer:

This option is the same as the option explained on the Customer Page.

3. Add Shipping Address:

Then enter the shipping address if different from the billing address.

Then decide your invoice No. format only One time then it will automatically get an increment to the next no.

like: if you decide 10001 then when you save the invoice it will automatically change to 10002. Special characters (|\/!@#$%^&*()) are not allowed in the Invoice.

then Today’s date will show automatically but you can change the date of the invoice if you want to but you can only change the date up to the date of your last invoice.

4. Select items:

Now, select the items to be billed. The process is the same as the selection of the customer. Here are two options for searching from old items and adding new items if needed.

Now, Select Quantity and Discount(if applicable) only for each selected item then click on Save & view Invoice.

You will get all three saved copies of invoices and print them if needed.

6. In the last Sheet:

You will get all your sales of the Day, Month, Quarter, Semester, and Year by applying a filter on it for your GST Returns.

Thanks for reading the topic of GST Invoice Format, please comment with your feedback whatever you want If you have any questions please ask us by commenting.

Please Share it with your friends.

So this merely means that you have nine outs to complete a flush. Generally, you should decide the strength of your hand and also determine the poker fingers that can be gained with it. Tory for a moment and appear at a feasible origin.

[…] GST Invoice Format 3.0 – Free Dynamic Excel sheet […]

[…] GST Invoice Format 3.0 – Free Dynamic Excel sheet […]

[…] If you looking for a Dynamic GST invoice generating excel template then you can check out our GST Invoice Format 3.0 – Free Dynamic Excel Sheet […]

EXCELLENT TEMPLATE IN A VERY USER FRIENDLY SPREADSHEET TEMPLATE!

I checked various free software to create GST INVOICE, but I found the above template to be Number One and really good!

Query: While creating the GST invoice, how can I reduce the number of rows from 25 to 10 (or less)?

Thanks a lot for your reviews and feedback. 🙂

Sorry to say that it can’t be controlled by the user.

We have to reduce and redesign the whole template for you as per your requirements.

So it is chargeable.

If you can use this as it is then it is free for a lifetime.

Add item & add customer button not working

Sorry for inconvenience

Please share screenshots.

We will check it and then fix it.

and please use Excel 2010 and above 2010 for proper working of software

Add Customer & add items button not working

Sorry for inconvenience

Please share screenshots.

We will check it and then fix it.

and please use Excel 2010 and above 2010 for the proper working of software

hey, i need to change some details and other stuff, so what is the password to unprotect sheet… help let me know the password. Thank You

Sorry.. editing is chargeable sir

how much u charge for removing lines Mr. sarbjit

For one adjustment which requires 30 minutes, I will charge Rs99 only.

its source code available?

Yes sir

RATE SHOULD BE ADDED AT THE TIME OF BILLING NOT BEFOR EVERY TIME RATE CHANGES

You can use discounts to issue different amounts of invoices

I am not able to ise this it’s show macros not available or macros disabled please tell me how can i fix this

Please don’t open workbooks. firstly press right click on the name of workbook then go to properties. At the end of the properties the security message will be shown. In the front of security message just click on unblock and then press apply or ok.

Now you can open the workbooks it will work smoothly

Dear Mr, Sarbjit ji, i am unable to open/operate this b’cos showing error :” VBE6EXT.OLB” COULD NO BE LOADED

it is working properly please share screenshot with me on my WhatsApp 8725972100

I tried this invoice format. Excellant. good working template form. Thanks

Most Welcome. and thanks a lot of feedback.